- Curved Lithium Polymer battery

- Fast Charge Polymer Battery

- Flexible Polymer Lithium Battery

- Ultra-thin Polymer Battery

/ Blog / Industry News /

Europe's Battery Industry: A Decade of Decline and the Path to Revival

27 Nov, 2023

By hoppt

"The automobile was invented in Europe, and I believe it must be transformed here." - These words from Maroš Šefčovič, a Slovak politician and Vice-President of the European Commission responsible for the Energy Union, epitomize a significant sentiment in Europe's industrial landscape.

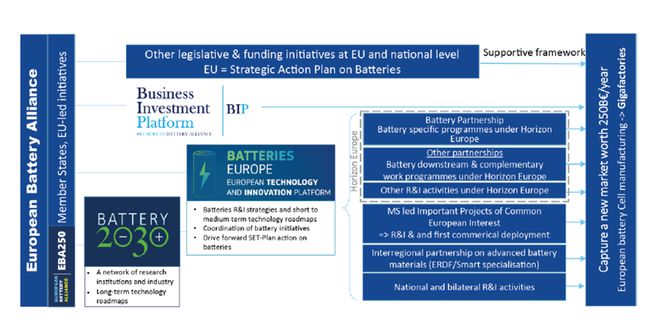

If European batteries ever achieve global leadership, Šefčovič’s name will undoubtedly be etched in history. He spearheaded the formation of the European Battery Alliance (EBA), kickstarting the rejuvenation of Europe's power battery sector.

In 2017, at a summit in Brussels on battery industry development, Šefčovič proposed the formation of the EBA, a move that rallied the EU's collective strength and determination.

"Why was 2017 pivotal? Why was establishing the EBA so crucial for the EU?" The answer lies in the opening sentence of this article: Europe does not want to lose the "lucrative" new energy vehicle market.

In 2017, the world's three largest battery suppliers were BYD, Panasonic from Japan, and CATL from China - all Asian companies. The immense pressure from Asian manufacturers left Europe facing a dire situation in the battery industry, with virtually nothing to show for itself.

The automotive industry, born in Europe, was at a juncture where inaction meant letting the global streets be dominated by vehicles unconnected to Europe.

The crisis was particularly stark when considering Europe's pioneering role in the automotive industry. However, the region found itself significantly behind in the development and production of power batteries.

The Severity of the Predicament

In 2008, when the concept of new energy started to emerge, and around 2014, when new energy vehicles began their initial "explosion," Europe was almost completely absent from the scene.

By 2015, the dominance of Chinese, Japanese, and Korean companies in the global power battery market was evident. By 2016, these Asian companies occupied the top ten spots in the global power battery enterprise rankings.

As of 2022, according to South Korean market research firm SNE Research, six of the top ten global power battery companies were from China, holding 60.4% of the global market share. South Korean power battery enterprises LG New Energy, SK On, and Samsung SDI accounted for 23.7%, with Japan's Panasonic ranking fourth at 7.3%.

In the first nine months of 2023, the top ten global power battery installation companies were dominated by China, Japan, and Korea, with no European companies in sight. This meant that over 90% of the global power battery market was divided among these three Asian countries.

Europe had to concede its lag in power battery research and production, an area it once led.

The Gradual Fall Behind

The innovation and breakthroughs in lithium battery technology often originated in Western universities and research institutions. In the late 20th century, Western countries spearheaded the first wave of research and industrialization of new energy vehicles.

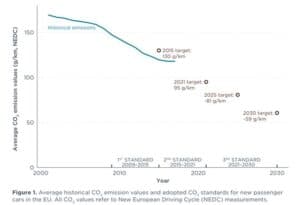

Europe was among the first to explore policies for energy-efficient and low-emission vehicles, introducing automotive carbon emission standards as early as 1998.

Despite being at the forefront of new energy concepts, Europe lagged in the industrialization of power batteries, now dominated by China, Japan, and Korea. The question arises: why did Europe fall behind in the lithium battery industry, despite its technological and capital advantages?

Lost Opportunities

Before 2007, Western mainstream car manufacturers did not acknowledge the technical and commercial viability of lithium-ion electric vehicles. European manufacturers, led by Germany, focused on optimizing traditional internal combustion engines, such as efficient diesel engines and turbocharging technology.

This over-reliance on the fuel vehicle path led Europe down the wrong technical route, resulting in its absence in the power battery field.

Market and Innovation Dynamics

By 2008, when the U.S. government shifted its new energy electric vehicle strategy from hydrogen and fuel cells to lithium-ion batteries, the EU, influenced by this move, also witnessed a surge in investment in lithium battery materials production and cell manufacturing. However, many such enterprises, including a joint venture between Germany's Bosch and South Korea's Samsung SDI, ultimately failed.

In contrast, East Asian countries like China, Japan, and Korea were rapidly developing their power battery industries. Panasonic, for instance, had been focusing on lithium-ion batteries for electric vehicles since the 1990s, collaborating with Tesla and becoming a major player in the market.

Europe's Current Challenges

Today, Europe's power battery industry faces several disadvantages, including a lack of raw material supply. The continent's strict environmental laws prohibit lithium mining, and lithium resources are scarce. Consequently, Europe lags in securing overseas mining rights compared to its Asian counterparts.

The Race to Catch Up

Despite the dominance of Asian companies in the global battery market, Europe is making concerted efforts to revitalize its battery industry. The European Battery Alliance (EBA) was established to boost local production, and the EU has implemented new regulations to support domestic battery manufacturers.

Traditional Automakers in the Fray

European car giants like Volkswagen, BMW, and Mercedes-Benz are heavily investing in battery research and production, establishing their own cell manufacturing plants and battery strategies.

The Long Road Ahead

Despite progress, Europe's power battery sector still has a long way to go. The industry is labor-intensive and requires significant capital and technological investment. Europe's high labor costs and lack of a complete supply chain pose substantial challenges.

In contrast, Asian countries have built a competitive advantage in power battery production, benefiting from early investments in lithium-ion technology and lower labor costs.

Conclusion

Europe's ambition to revitalize its power battery industry faces significant hurdles. While there are initiatives and investments in place, breaking the dominance of the "big three" – China, Japan, and Korea – in the global market remains a formidable challenge.